Europe, Where Are The Earnings?

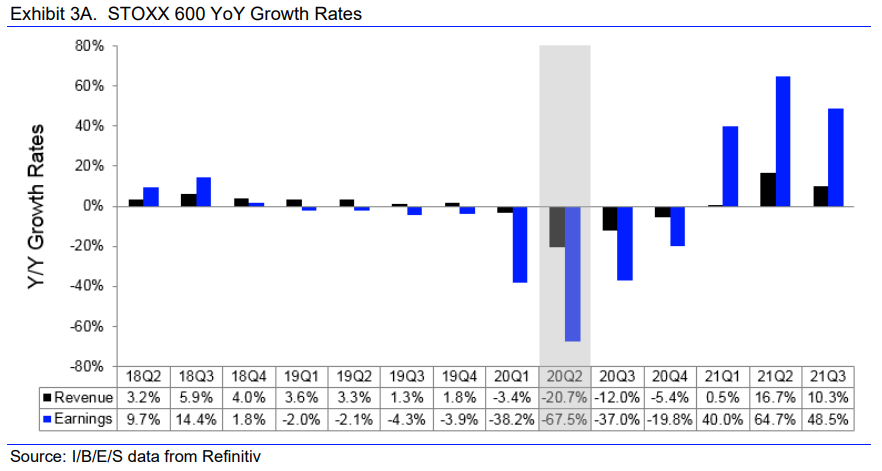

European companies, which were already very affected before the pandemic, are suffering a real drain in terms of business profits: the consensus estimate points us to a drop of more than 65% in earnings.

Furthermore, unlike the American market, earnings estimates for this year are being revised downward.

As we see in the graph, business profits in Europe have been declining for two years in a row.

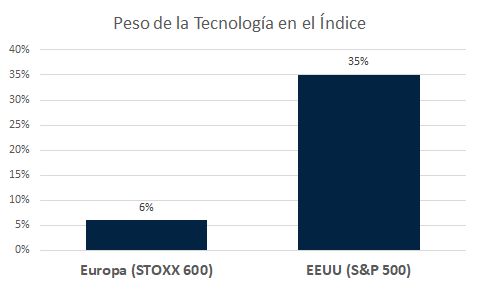

The anemic growth in Earnings per Share (EPS) of European companies is a direct consequence of the lack of dynamism in the economy and the poor presence of technology in European indices.

Unlike the American indices, where recently created companies are constantly being listed, in Europe the same companies have been listed in the index for decades. This is a symptom of poor innovation, difficulty in accessing the capital markets and greater obstacles when converting ideas into companies. At the end of the day, new companies play a big role in driving economic growth and technological development.

Finally, there is the commercial and technological war, in which Europe has a little to say, but would suffer its adverse effects.

Everything seems to indicate that, from a fundamental perspective, the American economy is better prepared to face the challenges of the 21st century. It is sure that american shareholders will benefit from it.