Countdown for Brexit

It seems that the negotiations between the United Kingdom and the European Union are stalled. Meanwhile, the clock is ticking, and the eleven months that both parts agreed as a transition period, which have accumulated with the Coronavirus crisis, are running out.

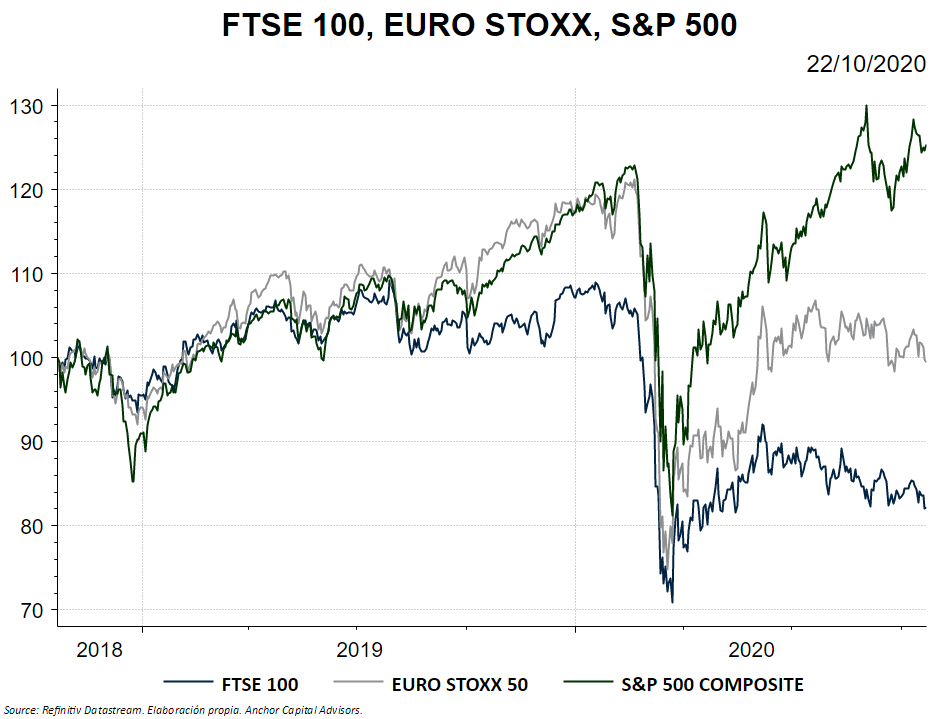

A Brexit without specific agreements or a "hard" Brexit it is more probable as time passes, and this is priced in the markets.

As expected, the markets, react with volatility.

What if there is no agreement on December 31?

The deadline to reach an agreement is December 31, 2020. If it is reached without an agreement, it would mean that the United Kingdom would be left out of the trade agreements with the EU, and goods controls would be applied at the borders, delaying thus shipping goods.

Without a doubt, this would be a bad scenario for both parties, but especially for the United Kingdom, since 43% of exports are to the European Union. The companies exposed to foreign trade would be very affected.

Anyway, apart from trade, there are also other issues on the table, such as the fishing sector (widely used in the pro-Brexit campaign), security and environmental agreements, among others.

What would be an optimistic scenario for the markets?

Considering this reality, a minimalist agreement in terms of trade, which is the most important part of the negotiations, would already be received with optimism by the markets.

In order to reach a mutually beneficial deal, both parties have to give in, and this is where the famous Prisoner's Dilemma emerges.

However, in this "game" of the prisoner of Brexit, the tangible incentives for non-cooperation are far from clear, so reaching an agreement is more necessary than ever.

Once again, we will see if politicians are guided by individual incentives (thus ending in the maximum common prejudice, or a Brexit without agreement) or by the common interest of people, who cry out for an agreement.