What is happening to the Banks?

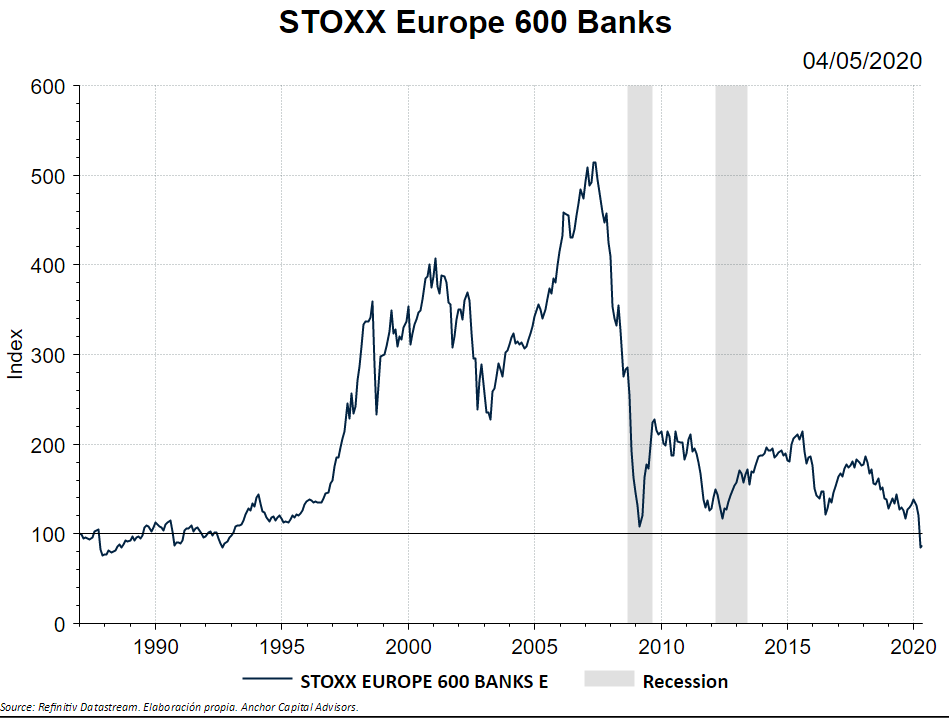

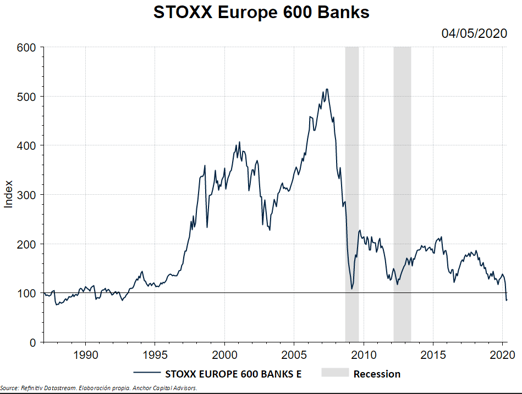

Recently, record oil lows are the focus in the economic news. Curiously, no one talks about European banks, which are also at lows, in many cases even below the lows of 2009.

In this post we are going to analyze, from a fundamental perspective, the reason for this situation.

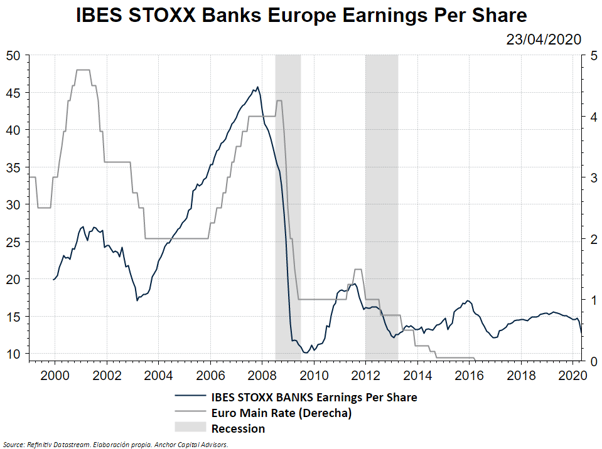

The first thing we must analyze is the profits of the banks. As we see, these are also at lows, in terms of EPS or earnings per share.

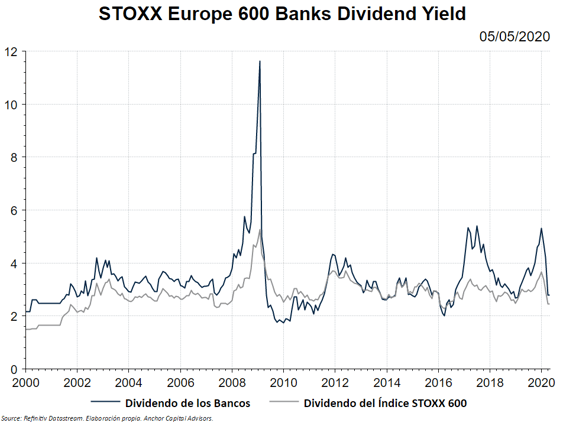

In any case, the dividend with which the banks remunerate the shareholder remains attractive. As we see in the graph, the returns are close to 3%.

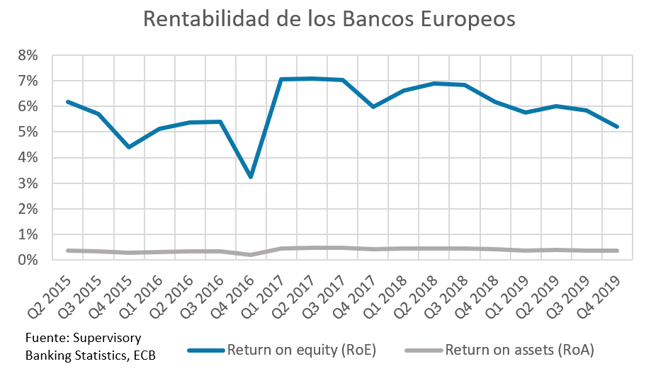

Regarding the economic profitability of the sector, we see that the profitability ratios of the banks are very low, especially the return on assets (RoA). The return on the assets is, for the most part, the return on the loans granted to clients and their portfolio of securities.

The most solvent clients tend to negotiate hard with the banks, ending up with a big quantity of credit with low interest paid. On the other hand, the banks offer little credit to the clients with low credit quality. These last ones are the ones who could be charged a higher interest due to the risk of default.

Therefore, bank's assets have little margin. This, can be compensated with more asset turnover, thus offering more volume of credit. However, the trend since 2007 is the opposite. Since then, we are seeing a decrease in the outstanding credit balance.

This is a direct consequence of the ultra-low interest rates of the European Central Bank, which with this policy makes the banking business an unprofitable business.

In addition, the Basilea agreements require higher capitalization for the banks. In other words, more own resources (Equity) on the balance sheet. That is noticeable in the RoE or return on equity: the capital requirements have practically doubled since the financial crisis, thus reducing the leverage, and resulting in a low return on equity.

Low interest rates have caused banks to create other ways of generating income. To make up for the lack of income on the financial side, banks are increasing their fees more and more. Now, fees are an average of 30% of the bank income. And this number is increasing.

If we leave low interest rates aside, we see that the banking sector suffers from enormous regulatory risk and low economic and financial profitability, with the uncertainty for the investor, who prices all these factors in the market.

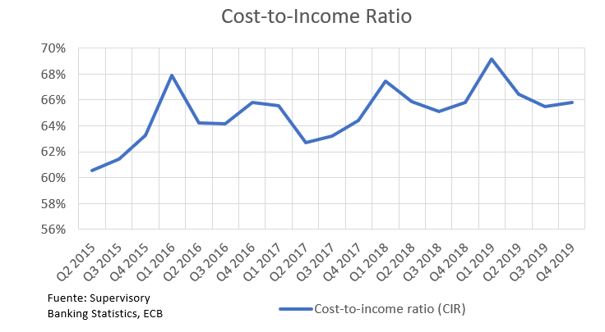

The increase in regulatory and restructuring costs results into less efficiency. If we look at the Cost-to-Income Ratio, that is, how much it costs to banks to generate income, we see that it is 66%. Said differently, generating an income of 100 costs them 66.

In other banks, such as Nordic or North American ones, this ratio is close to 55%. This tells us that European banks have more costs for each unit of income they generate. In other words, they are less efficient.

Digital transformation is another variable to consider, since it is exposing the sector to great technological risk, with innovative technology companies (FinTech) increasingly taking more pieces of the pie.

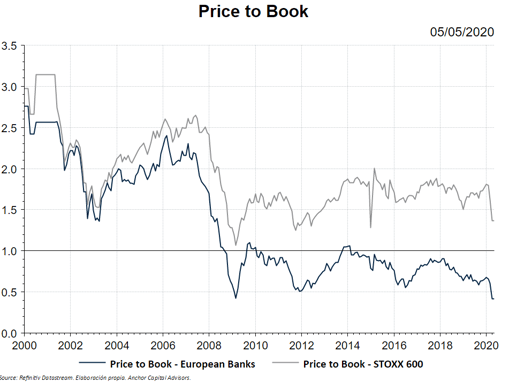

All these negative factors are evident in the market, where we see that, apart from the low prices, the market value is the half of the book value accounted in their balance sheets (Price to Book Ratio). This is indicating to us that the banks are cheap.

If we look back, the banking business underwent a bubble stage before the 2009 financial crisis. In the earnings chart that is clearly seen. The great facilities to give credit were its main factor.

Consequently, the debt levels of the economic agents increased, and the banks came out as the main winners.

Today, the picture is very different. That party is over, and the music has stopped playing.

As Warren Buffet said, price is what you pay, and value what you get. In the case of banks, we see that the price is low. Probably, the value is also low.