Value investing: tailwinds

It's no secret that Value investing is doing better than Growth in 2022. Here's a look at why Growth has been badly hurt this year, and whether that could present an opportunity.

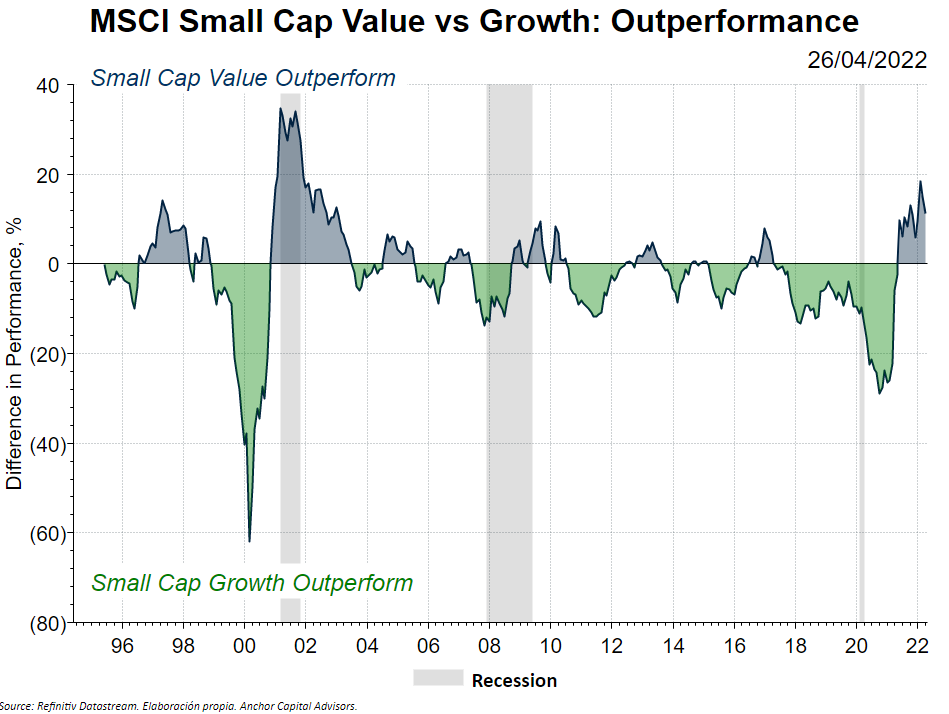

In the following graph we can see how, in the Small Cap area, the Value has already been doing better since 2021.

Inflation and Commodities

Many of the value-biased companies are in highly favored sectors when commodities rise:

- Energy: especially non-renewable. We are seeing in many companies stock price increses between 25% and 40% depending on the company.

- Metals & Minig: mining companies are selling their products at much higher prices than in the past. The index is already more than 10% up this 2022.

- Financials: special emphasis on the more traditional banks, where rate hikes can increase the net interest margin. Nevertheless, they are negatively affected by increases in mortgage rates, since they grant fewer mortgages and foresee a slowdown in that market.

Rate hikes

Growth companies, as they have their Cash Flows further away in time, are more affected by rate hikes. In such a context, we would prioritize companies with current cash flows, that is, that are profitable today, especially with good cash generation.

Market opportunity?

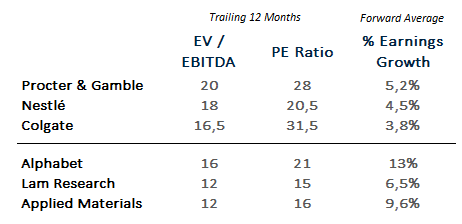

Many times, the market overreacts to these types of growth-biased companies. Thanks to this we can find excellent opportunities in the market, where companies with higher growth are trading at lower multiples than companies that do not grow as much:

However, macroeconomic factors and market sentiment count as well. Currently, we are in "risk off" mode and, probably, in a "Late Stage" macro cycle, so we do not rule out better returns from companies less biased towards growth in the short and medium term.