A good earnings season, a bad guidance

Published by

Josep Duran

on

The earnings season for the last quarter of 2021 has not left anyone indifferent. In general, we can talk about a very good earnings season:

- 77.3% of the market has beaten revenue expectations, when the historical average stands at 61.5%

- 78.4% of companies have beaten earnings per share expectations, when the historical average stands at 65.9%

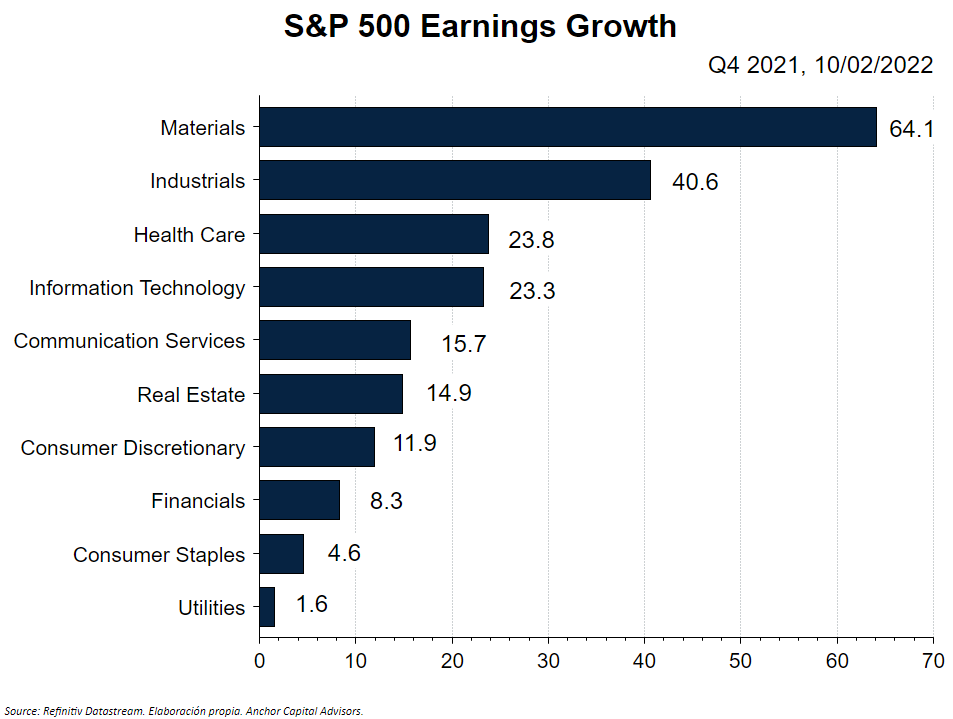

In any case, the sectors where profits have grown the most are where the base effect has been greatest. For this reason, we have left Energy out of the following chart, where EPS grew by 11,180.4%.

Bad forecasts behind good numbers

But it's not all good news. Despite initial joy at seeing companies do better than analysts expected, while CEOs were explaining that they were maintaining (or even downgrading) the outlook for 2022, stocks suffered.

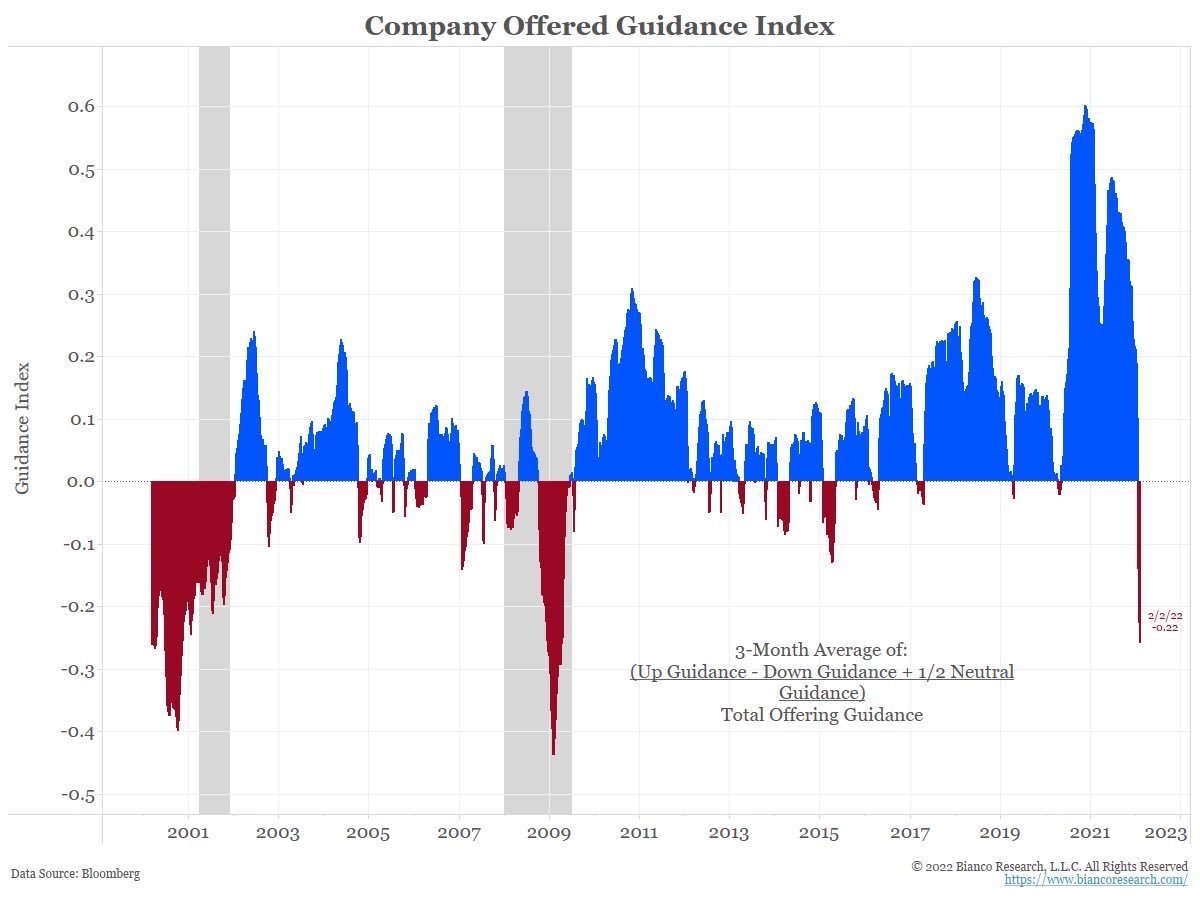

And it is that, as we see in the graph, we have not seen such a bad forecast reduction (guidance) since 2009.

This marks a major change, as we have moved from exuberant growth prospects to stark reality. Was the market discounting too much growth?