SPACs - Are they here to stay?

SPACs - Special Purpose Acquisition Companies - have become a very popular vehicle for investors to access private companies through an IPO. The objective of these entities is to offer an alternative channel to private companies to raise capital as a preliminary step to going public.

Despite the pandemic, the number of IPOs in 2020 has doubled that of 2019 with 494 for the entire year. Taking into account that on average, the shares of the companies that went public saw their value increase by 88% on the first day of listing, we can understand the phenomenon of SPACs as an euphoria to enter a market previously monopolized by big investment banks and which has unclear valuations.

But since all that glitters is not gold, the investor interested in accessing this type of vehicle must take into account certain associated factors. According to various analysts, the cost of entering a SPAC is close to 30%, so if the companies acquired by the SPACs do not experience an appreciation of at least 42%, the investor will be losing capital (at least up to exceed that threshold).

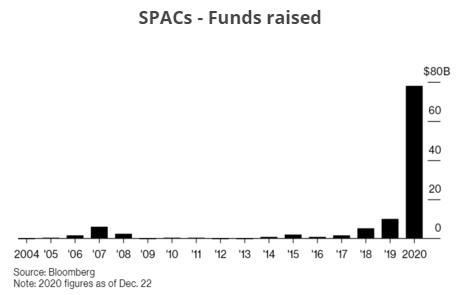

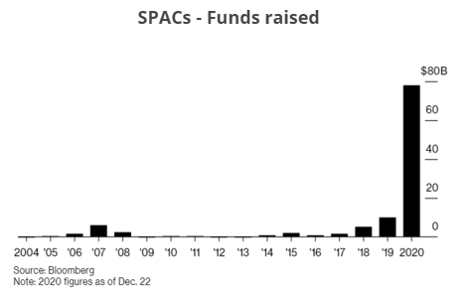

On the other hand, companies that go public in general are in a very early stage of their business, so investors are acquiring a stake in a company that loses money and which future is absolutely uncertain. Despite this, the amount raised by the SPACs during 2020 approached 100 billion dollars, so the boom in these instruments seems to have come to stay.