Infrastructure Plan: What companies should I have in my portfolio??

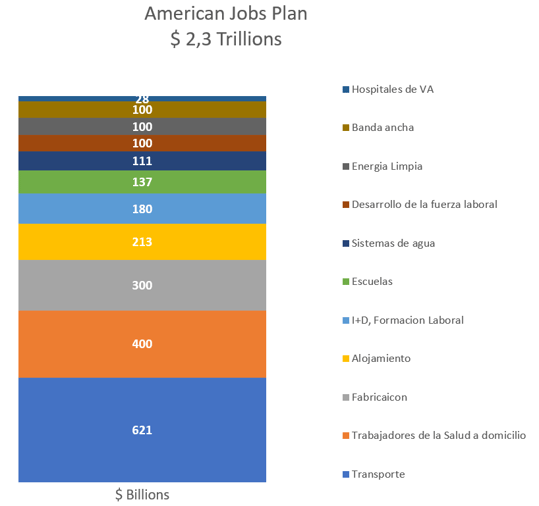

The conflict to raise the debt ceiling in the US is creating tension in the economy and uncertainty about the American Jobs Plan. Here is the breakdown of AJP's $ 2.3 Trillion investment, published by the Biden government itself:

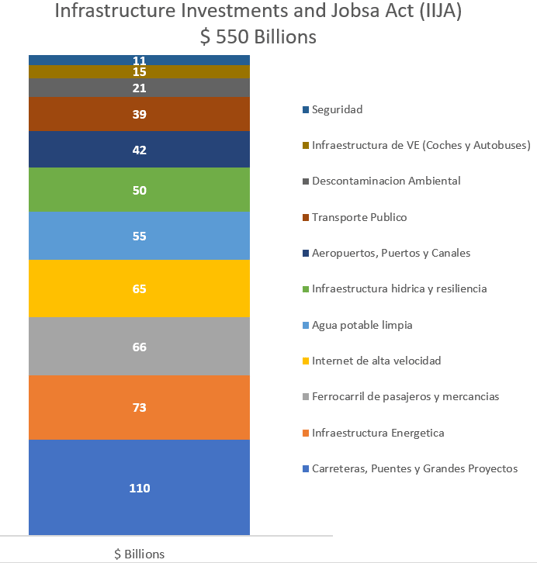

Apart from the AJP, we have the Infrastructure Investment and Jobs Act. This last one is a bipartisan plan that will probably end up being approved. The Keynesian plan aims to boost the economy, improve competitiveness and create jobs from the public sector.

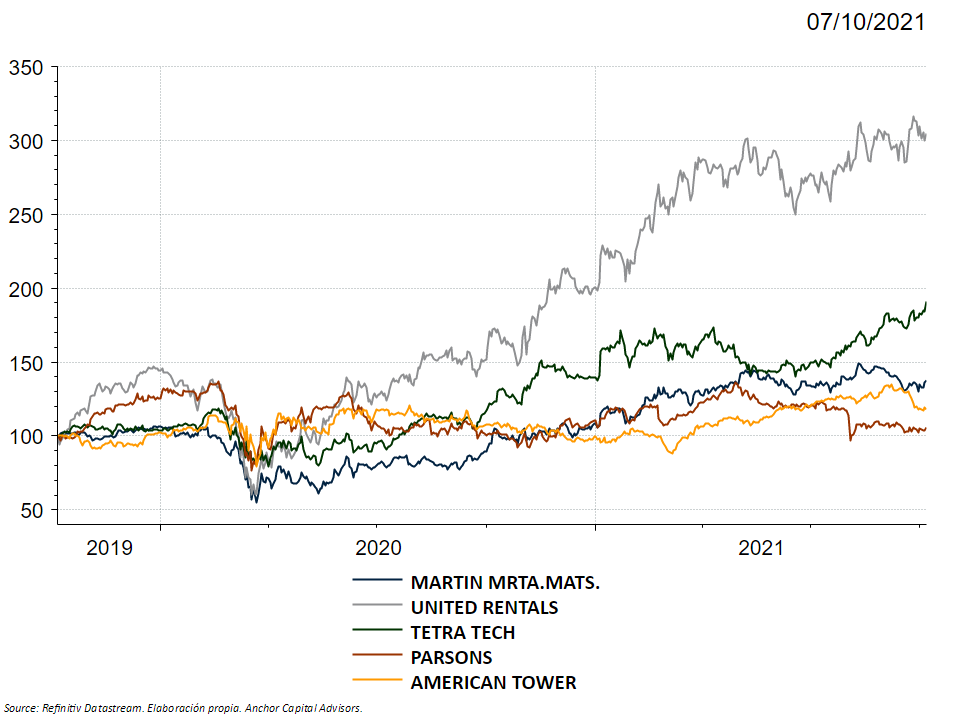

With all that money on the table, these following companies can take advantage from these huge public spending plans:

- United Rentals: the company is engaged in the rental of all types of machinery and industrial material, and has a large customer base. Part of the federal spending on infrastructure will be used to rent infrastructure equipment.

- Martin Marietta Materials: it is a chemicals manufacturer specialized in large construction and infrastructure projects, and aleading provider of cement and asphalt services. It is already benefiting from strong growth in public infrastructure.

- Tetra Tech: provider of consulting, engineering, program management and construction, and technical services. It operates in various segments like water, environment and infrastructure and resource management, among others. It has obtained an $ 800 million contract from “USAID” for the next 5 years.

- Parsons corp: leading provider of disruptive technology in global markets. Selected in 2020 (and currently) to support the Southern California Regional Rail Authority as one of five engineering firms for $ 50 million over three years.

- American Tower corp: it is among the largest wireless communication and transmission tower owners and operators in the US and around the world. Dividend has been increasing for 40 consecutive quarters.

Despite many of these companies have risen in value during the last year, all is not priced in yet. If our investment thesis is that the US economy is going to emerge stronger from these plans, we should at least invest in one of these companies. On the contrary, if we have a more technological or growth bias, we may be reluctant to buy these more "value" style companies.