Money flows to High Yield

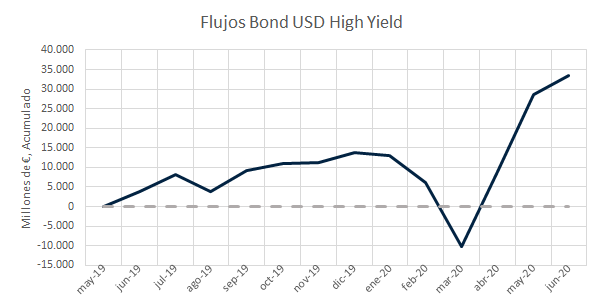

During May, we have seen a strong inflow of money in the American High Yield sector, accounting for 19.6 billions of €.

Nevertheless, we also experienced another 19 billion € inflow during April, so this is not new.

Fuente: Lipper Database. Elaboración Propia Anchor Capital Advisors.

The correlations tell us that the High Yield can be considered as an asset more like the stock market than to bonds, since these two categories tend to behave similarly.

Recall that the American High Yield suffered a sharp drop in prices during March, as well as the stock market. In the case of the High Yield, the losses ranged between 15% and 20%.

This big drop in prices was accompanied by a large outflow of money during March due to the crisis. That outflow was about 16 billion €. The fear of a wave of corporate defaults was put in price.

The new measures to support liquidity, promoted by the Fed, mitigated the risk of the High Yield assets, which were pricing defaults during March. In a zero-interest rate context, those March prices became attractive. As liquidity improved, corporate defaults looked so much better too, and that is what we have in price today.

Nowadays, High Yield investors have not fared badly, and they are slowly recovering from the losses they suffered during the first quarter of 2020.