E-Trading on Lockdown

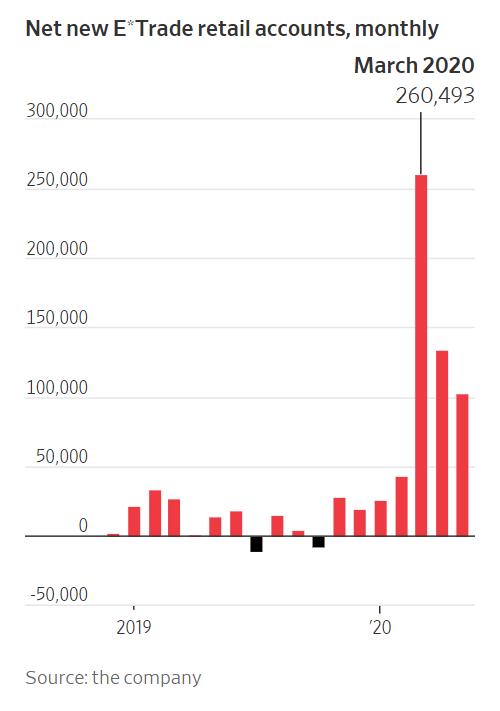

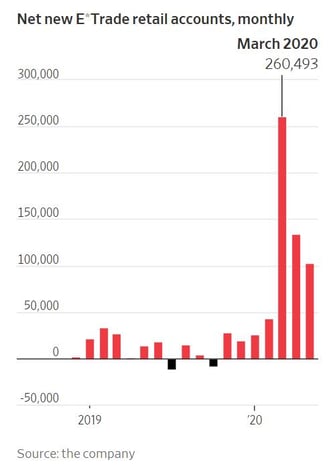

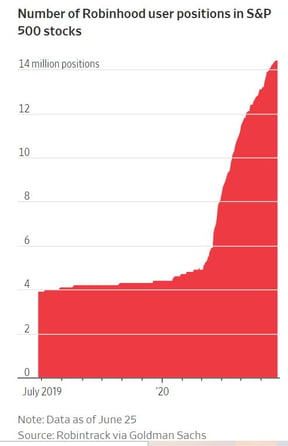

Recently, some trading platforms have informed us of the impressive numbers of new users created during the months of March and April.

Lockdown has caused hundreds of thousands of Americans to choose a new hobby: investing in the stock market.

Nevertheless, this is not new. As this article on The Wall Street Journal mentions, last time we experienced a similar situation was during the dot-com bubble at the end of the last century.

However, the reasons may be different. Whereas during the technology bubble new traders were fueled by euphoria and easy money, now this new users of trading platforms may be motivated by boredom or curiosity.

Any investor, whether professional or retail, has to be aware of the risks involved in investing.

The CNMV, which is the supervisory authority in Spain, has an Investment Guide for Retail Investors on its website, which raises the basic questions that every investor must answer before investing.

On the other hand, independent financial advice helps the advised client to meet their investment needs in a personalized and tailored way. In this sense, the advised client can avoid the biases to which the non-advised investor is exposed.

The fact is that, as the different trading platforms are obliged to report, a large majority of retail investors lose money.

At the end of the day, investing while being well advised makes the difference.