High-yield: high risk, low yield

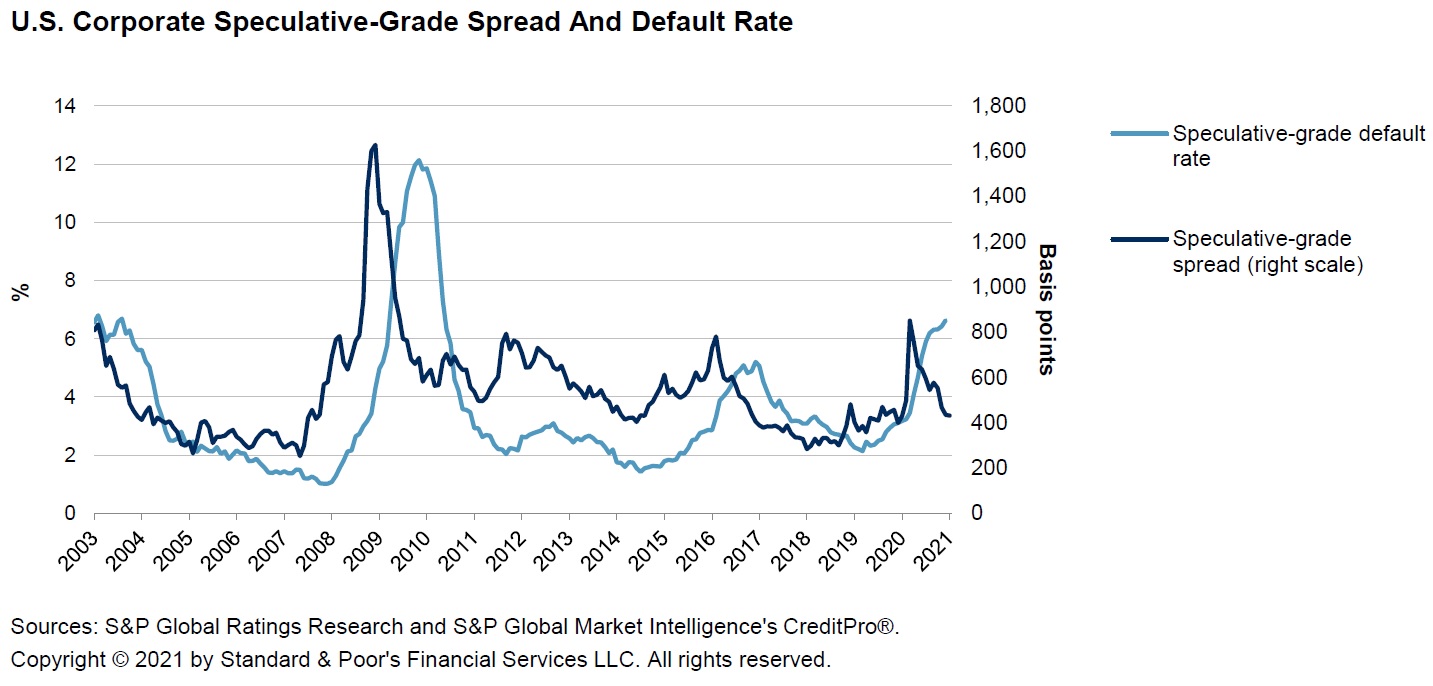

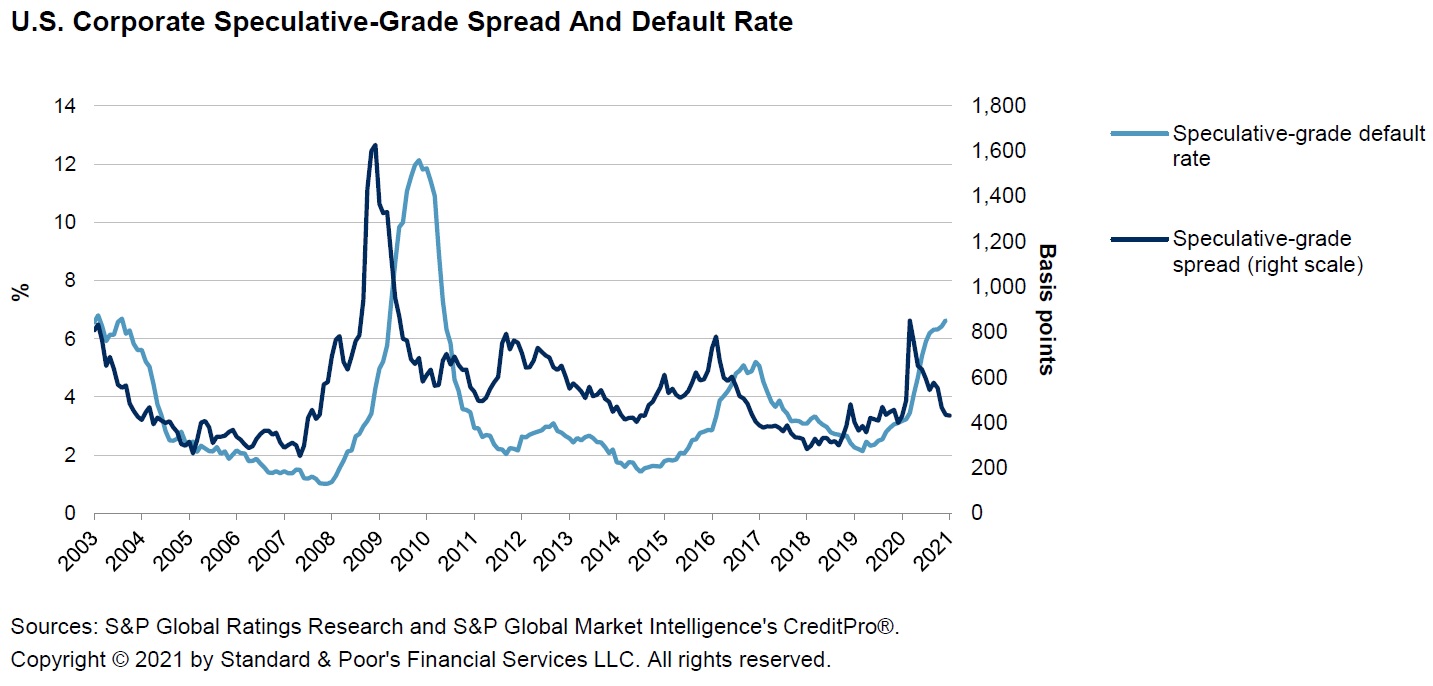

At the beginning of the Covid-19 pandemic, fears about a strong impact on defaults on corporate bond issues strongly shook prices and spreads on fixed income. In particular, those of the speculative grade (high-yield) issues of the lower-rated tranches. The yield on the bonds rose sharply, offsetting the risk of default.

However, the rapid response of corporate liquidity support mechanisms, as well as the broadening of the purchasing scope of unorthodox central bank intervention programs to include high-yield bond funds, eased the pressure on prices.

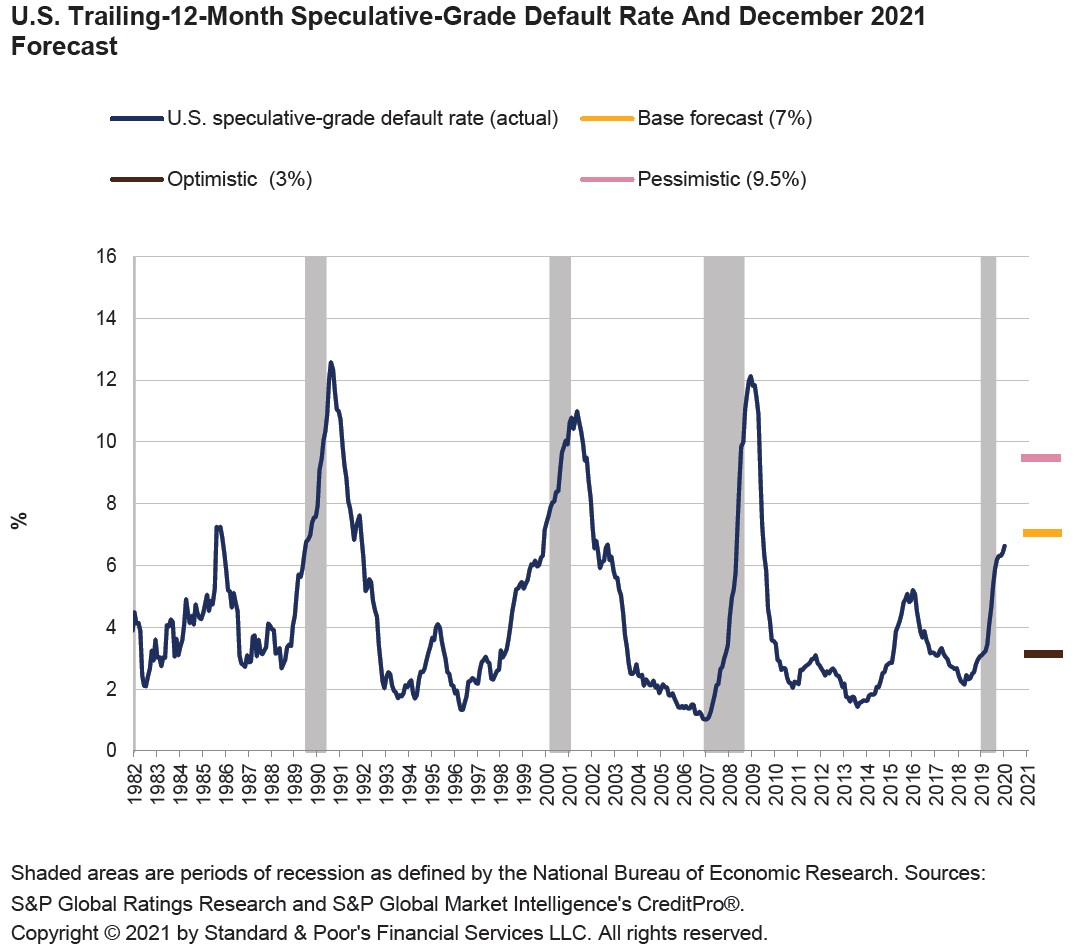

Expected default rates soared to levels similar to those of the great financial crisis. However, due to the different nature of this episode, the actual consequences could be much less severe and end keeping closer to 3%.

The fundamental reason is that, in the case of the pandemic, the origin is a lack of liquidity in those companies whose activity depends heavily on physical presence and that, given the mandatory closure of their activities for health reasons, have to assume fixed costs without recurring income. In this case, the length of the closings is directly related to its ability to pay interest and principal on its debt issues.

On the other hand, the risk of refinancing is much lower, since the bonds maturing in 2021 are barely 130 billion USD on a market that issues close to 750 billion annually. Of the maturities, more than half are BB issuers, which highly likely may refinance its debt.

All in all, current high-yield bond yields are unattractive as they already discount the best-case scenario, with spreads adjusted to a default level close to historic lows. Better to make cash.