Dividends and the Power of Reinvesting

Dividends are one of the factors to consider when calculating shareholder profit. Nevertheless, their reinvestment and their taxation may lead us to think that they are not the best option in the long term.

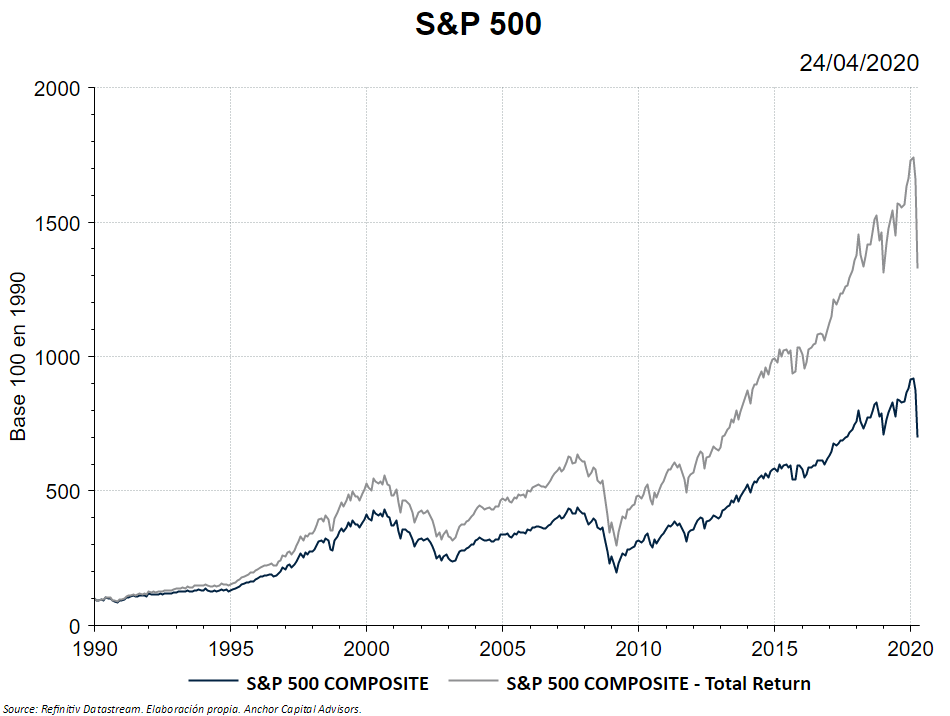

In the following graph, we see the difference in accumulated yield in 30 years of the S&P 500 without dividends and the S&P 500 with the dividends reinvested in the same companies. In the long term, the difference is quite big.

If we need a more or less secure cash flow, dividends are a good idea, since they provide liquidity in the short term and stability in quantity over time.

In contrast, if we do not need to have that cash flow every year, we can invest in an investment fund where the dividends are reinvested, thus capitalizing our investment.

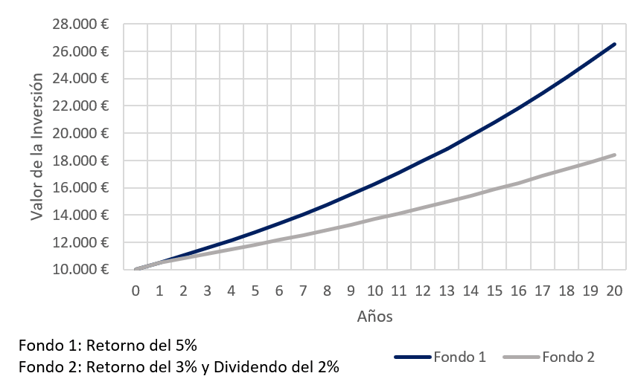

Here is an example where we have applied an annual rate of return of 5% in the Investment Fund 1 and an annual return of 3% in Investment Fund 2, plus a dividend of 2% per year.

As we can see, the difference in profitability over the years is large. Also, the more years you are invested, the more it increases, due to compound capitalization.

Last but not least, we have to deduct the taxation of dividends, which is a factor with a huge effect on the final profitability over the investment when dividends are distributed. On the other hand, if they are not distributed and reinvested in the investment fund, they are not taxed and will do so when the investor sells his share of the fund.

We must not underestimate the power of reinvestment. In fact, it is said that Albert Einstein himself stated that the compund interest could be the "eighth wonder of the world." Maybe he could be right.