Maritime transport: The goose that lays the golden eggs?

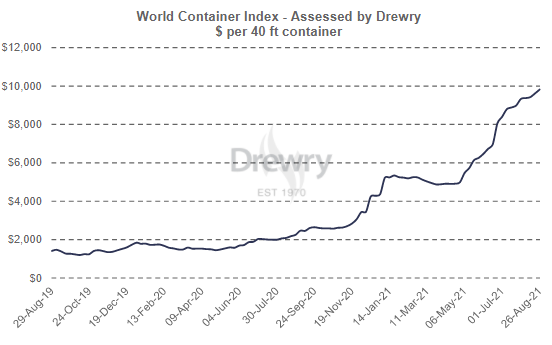

The rising cost of maritime transport is one of the main concerns of importers right now. This rise in costs is also having an impact on consumer goods, with widespread price increases that, if sustained over time, will translate into inflation.

Container shipping costs have multiplied by 5 since last year.

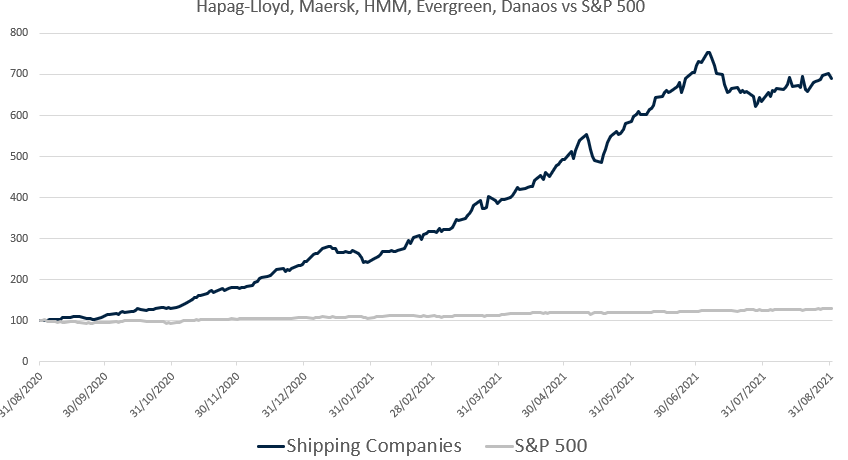

As a consequence, this has benefited companies in the sector, in the form of revenue increase. At the same time, its market value has skyrocketed:

Although the gray line looks flat, the S&P 500 has grown almost 30% since last year. This is a very good figure if we consider that, on average, the S&P 500 has given approximately 10% per year.

Instead, these shipping companies, on average, are up 590%. In other words, if we had invested € 10,000 in a basket of these companies, we would now have almost € 70,000. Amazing.

Do they have more room to grow or everything is already discounted?

The apogee of the shipping bottleneck appears to be coming to an end. It is expected that, as the situation normalizes, that is, the demand boom during 2Q 2021 and 3Q 2021 eases, freight costs will ease.

However, there are still disruptions in the production chains and the new variants of the Covid-19 virus can lead to the closure of some ports in Asia and keep transport costs high, so the outlook is still uncertain in the short term.

Multiplying by 7 an investment in a year is already an exceptional return. Any investor would be more than happy if he can make this annual return once every fifteen or twenty years.

Therefore, from an individual point of view, the cautious thing would be to withdraw positions in these companies if we are invested in them. Let's be cautious, cause the greed might break the bag.