Earnings Season: Expected Disappointment?

The already published results of Q1 2022 have not left anyone indifferent. Despite the fact that many companies have revised their guidance down due to the rise in production costs, the results have been better than expected at the beginning of the year.

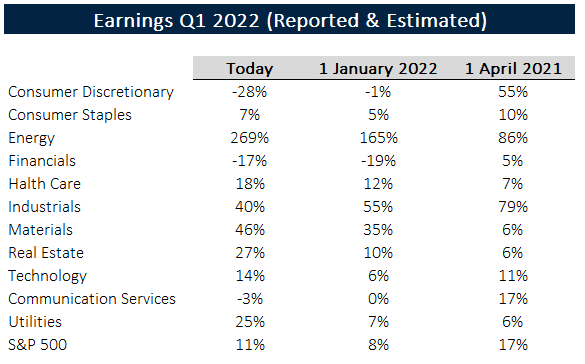

YoY Growth in EPS, Blended (Reported & Estimated) for the 1Q 2022 in the S&P 500. Source: Lipper Alpha

Compared to last year, growth forecasts have deteriorated notably, especially in Consumer Discretionary, Industrials and Financials.

But that is already old news, since most companies have already published and that is already discounted in prices.

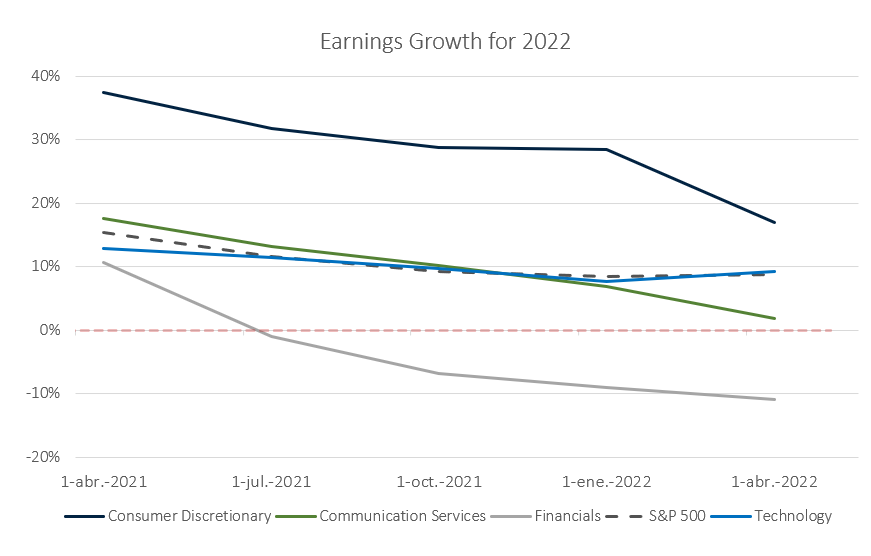

The forecasts for the whole of 2022 shows the slowdown in the economy for this year. And not only that, but it gives us a glimpse that the expectations for some companies were too inflated:

The most cyclical companies exposed to growth are the ones that are suffering the most. If we add high multiples to the revisions in earnings growth, we would have the explanations for the market declines.

These could seem exaggerated if we only look at the benefits side, since they are still growing, but we also have to take into account a drop in price due to the high multiple we were paying.