Which Sectors are Revised Up?

Earnings being revised higher is a great sign of economic health for companies. Nevertheless, not all sectors follow the same trends depending on the market trend.

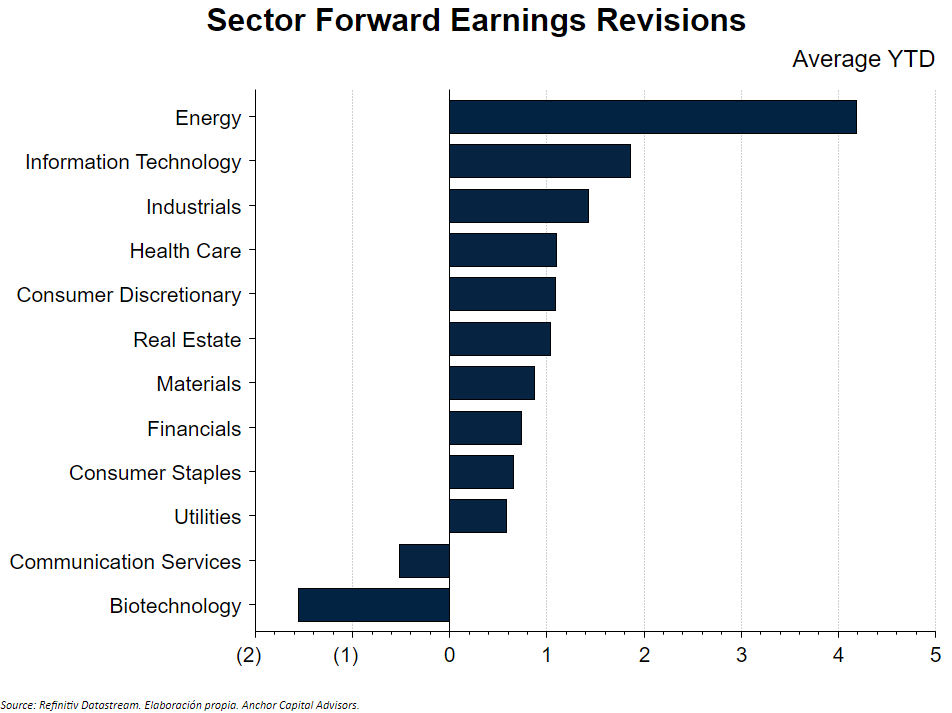

In the chart below, we see how next year's corporate earnings are being revised.

The percentage that we see in the graph is the average with which profits have been growing, month by month, from this beginning of the year until next year. Ifannualize this rate, we could extrapolate how much profits would grow in 2023.

Clearly, energy and raw materials price rises have caused analysts to revise their estimates for the year 2023 upwards.

In the same way, Technology continues its good growth rate, continuing the trend that began during the pandemic.

On the contrary, the negative notes are taken by Biotechnology and Communication Services, two sectors highly dependent on growth rates to generate profitability. The worst "guidance" presented by companies during this last earnings season has had a lot to do with it.

Rising Earnings and Valuations?

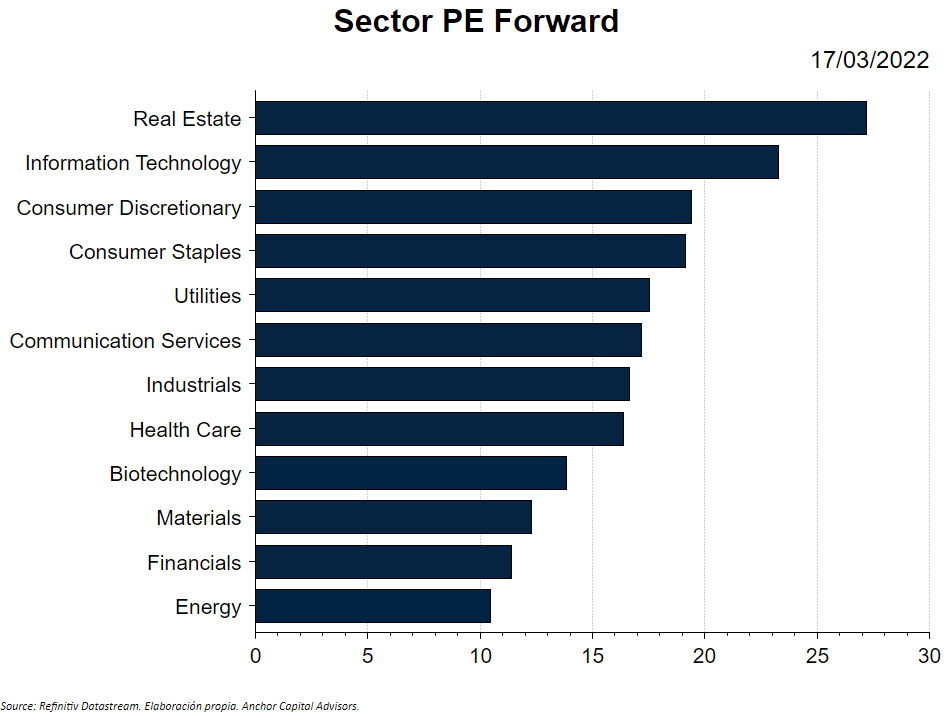

Not all sectors where earnings are revised higher have more demanding valuations in P/E terms. Sectoral portfolio rotation has something to do with it.

This is the case of Energy, which trades at a low profit multiple in relation to how much its forecasts are adjusted upwards, although the penalty for environmental sustainability factors justifies it.

The opposite is true for Biotech and Technology: the biotech sector is trading at a low multiple with earnings being revised down, while the tech sector may sustain a high multiple on expectations of higher earnings growth.

Any surprise in the forthcoming earnings releases could create good sector opportunities, but also some eventual deep correction.