Index investing, is it for everyone?

The staunch defenders of index investing will argue that opting for a passive fund is the most rational decision, since we are most likely to win: only if we take into account the costs of active management (usually around 1%-1.5% ), we already have better performance ex ante.

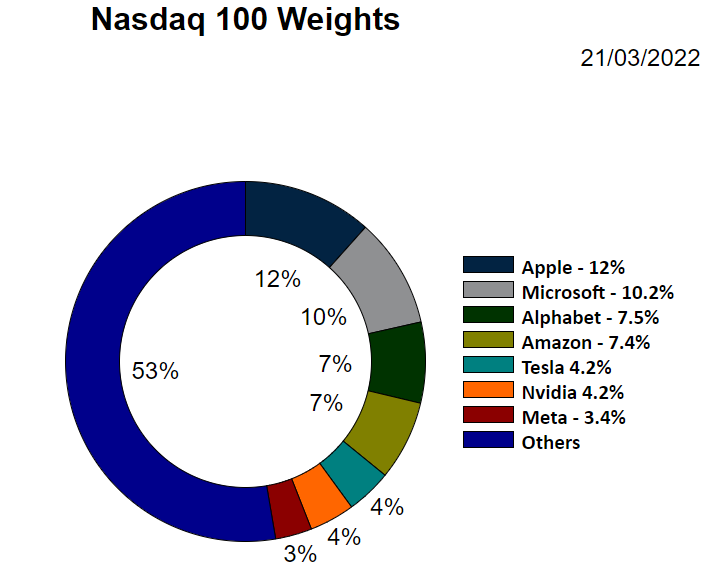

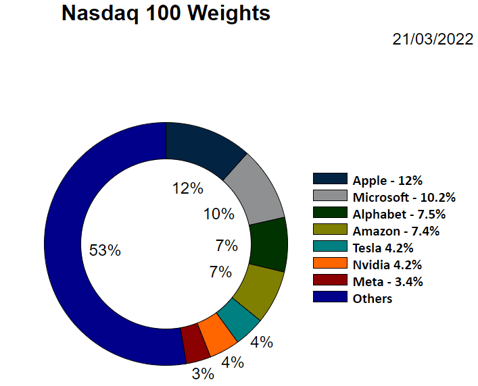

On the contrary, the supporters of active management warn us that an indexed portfolio can have too much weight in some "fashionable" values of the moment. And, despite the fact that the word "too much" does not have the same meaning for everyone, they are right:

In the graph we can see how the first 7 positions of the Nasdaq 100 index account for 47% of the portfolio. As a result, we will have a somewhat binary portfolio, where 50% of the portfolio is not very diversified, but the other 50% is.

At the end of the day, if we buy an actively managed fund, we are overpaying to get ahead of our benchmark. Imagine a world where 30% of managers beat the benchmark: in this case, we would be buying a 30% chance of beating the benchmark at a cost of 1.5% per year.

Passive investing is a momentum strategy

Inevitably, if we buy a passive fund, we will be buying the companies that have performed the best (have the largest capitalization), over the smaller or less valued ones, so we will be giving greater weight to companies that have had a recent positive trend, although they might be more expensive.

What is clear is that, if we trust the large companies that dominate the top positions in the indices, it would not make much sense to buy an actively managed fund.

The importance of being well advised

Direct contact with a financial advisor will allow the investor to be more informed about their investments, to know the sources of risk in their portfolio and to better adapt their investments to their risk profile. Otherwise, if we opt for a non-advised and passive portfolio, we will be at the mercy of the often cruel financial markets.