Renewable Energies: fair valuations?

The new decade has started with a very clear objective: to reduce emissions of polluting gases.

One of the most polluting factors (with 40% of total global emissions) is the generation of electricity, since it currently depends mainly on non-clean sources.

This brings us to the alarming fact about renewable energies: they only account for 2% of the total supply of electricity worldwide.

What is the growth required to achieve a cleaner energy mix?

According to IEA data, world energy consumption has grown at a rate of 3% from 1990 to 2018. Knowing this, we infer a future growth in demand of 2% for the next years, since energy consumption and energy supply does not usually grow at the same pace, but they move between 1 and 3% if we look at historical figures.

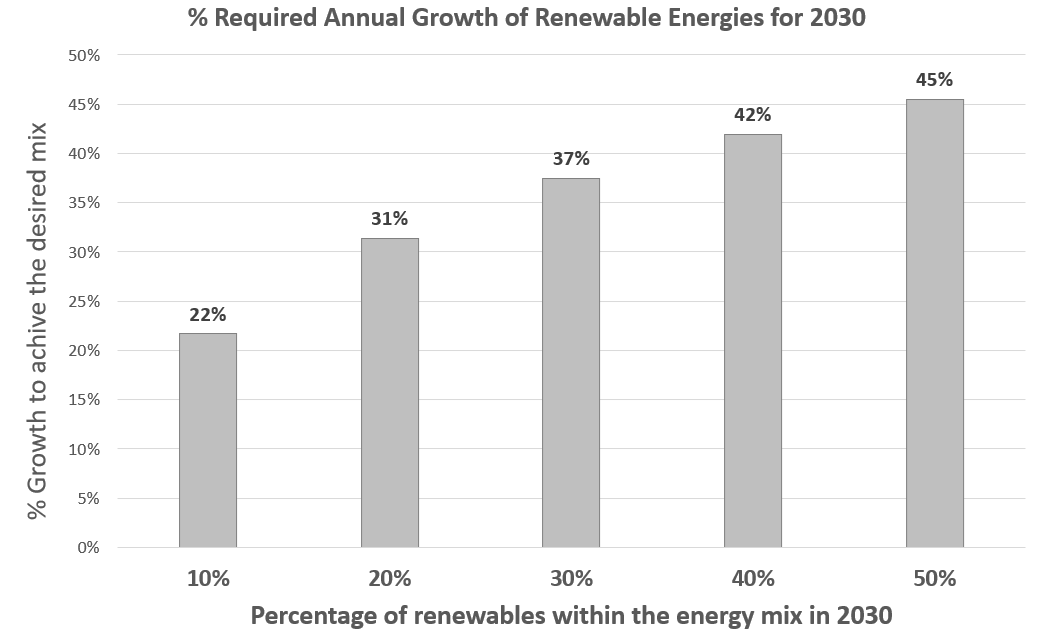

If we add this "natural" growth in energy demand as a whole (2% per year) with the necessary growth in renewable energy to achieve a sustainable energy mix, we have the following graph:

Datos: IEA. Elaboración propia de Anchor Capital Advisors.

Datos: IEA. Elaboración propia de Anchor Capital Advisors.This means, for example, that if we want renewables to be 10% of the world's energy mix in 2030, they must grow 22% each year until 2030. In total, that would mean multiplying the generation of renewable energy by six compared to the current level (in tons of oil equivalent).

Therefore, we can expect the sector to grow to figures close to these. In any case, it is not a figure that can be directly translated into sales or profits of the sector, since there are production and efficiency factors involved that distort the direct conversion of energy produced to income or direct profit. However, it is an estimate tight enough to make forecasts.

Are the high valuations justified?

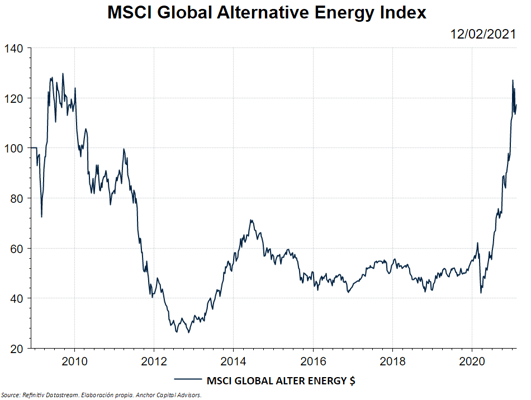

Currently, the market is discounting a very high growth for renewable energy companies, with very high multiples.

However the index does not trade at a price as high as one might expect, if we compare it with 2010.

One of the difficulties added to this market is that the companies are very small. In fact, the total capitalization of this index is 260 billion USD. To give us an idea, this would be the market value (market cap) of Netflix. Also, most companies in the index do not generate a profits, so they are currently incurring in losses.

In conclusion, we see a very small market, where most companies do not make money and with many investors trying to enter through a bottleneck. The result of this funnel is an exponential growth in prices, as a few companies take the lead, regardless of whether the fundamentals justify it or not. The market still has a lot of ground left to develop if we want renewables to have a greater weight in our energy mix.

.jpg)