The risk of not seeing risks

The first half of 2022 has been one of the worst in the history of the stocks. The market, which was not pricing in any risk this year, has suddenly found itself in the perfect storm.

Slowdown and growth

The cuts in growth expectations are the main driver of the stock markets. Many companies are already cutting guidance for this year. In turn, the global GDP growth forecasts for this 2022 have been reduced by one hundred basic points.

Inflation and the FED

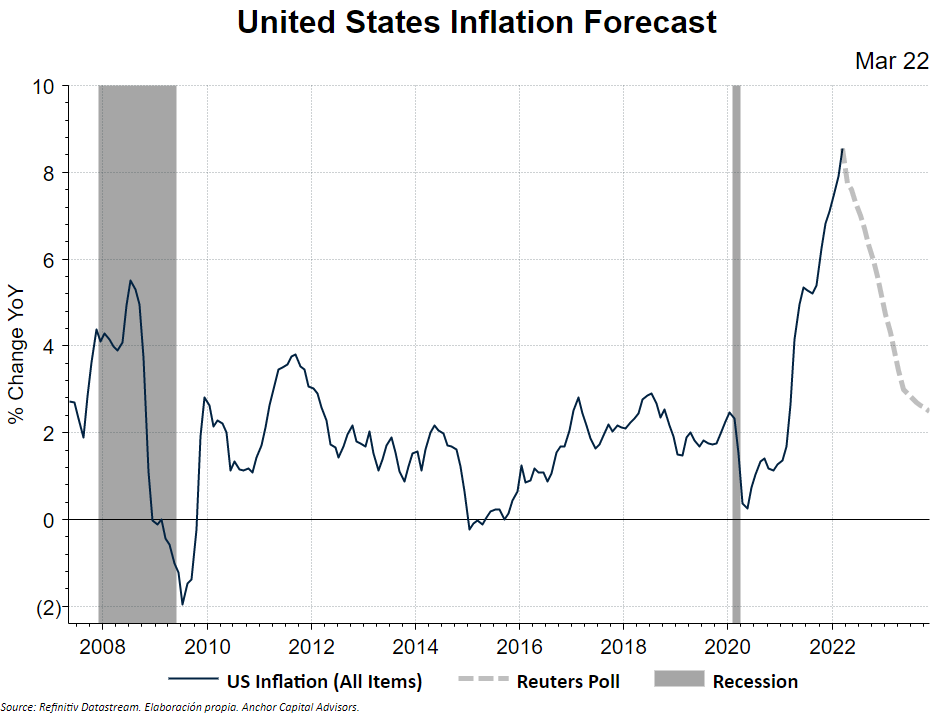

Just as the Fed has flooded the market with liquidity for the past two years, the overreaction may now come from the other side. A FED that fails to nail the soft landing could trigger a recession or, at least, certain quarters with drops in Gross Domestic Product.

After the meeting on Wednesday, May 4, the market seems to be unsure whether to believe Powell's speech, which did not seem entirely convincing. Currently, the market is pricing in more probability of a 3/4 point rate lift than 1/2 of a point, although Powell claimed otherwise.

China

China's tough policy against Covid-19 has several consequences for the markets. The strict lockdowns in the cities of Shanghai and Shenzen (where important parts of the production chain of technological products are located) may have unintended consequences.

Also, the Chinese retail space is affected. The slowdown in the Asian giant may bring headwinds for Commodities, since China is a major importer of raw materials.

Wars and geopolitics

The consequences of wars are often large tail risks. An even greater escalation of geopolitical tensions could trigger economic sanctions against countries allied with Russia, such as China, further accentuating the bad relations between the United States and the Asian giant. Sanctions on Russia are likely to continue even after the conflict ends.

Conclusion: there is no benefit without risk

In addition to the risks mentioned, we can also find liquidity tensions in the riskier fixed income market, social conflicts due to the rise in the cost of living, historical levels of government debt and problems in the American Real-Estate.

And it is that there will always be risks hovering over the markets. If there are not, it is a bad sign, since, many times, the main risk is not identifying risks.