US Dollar or Euro, that's the question...

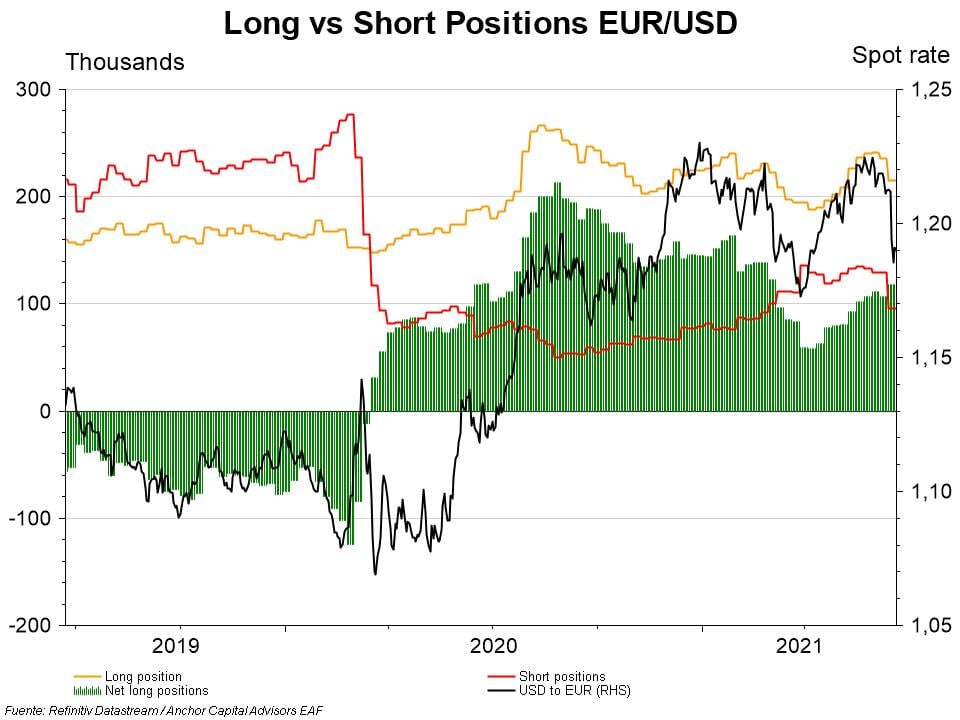

The US dollar has suffered a strong depreciation since the beginning of the pandemic in March 2020. The aggressive monetary policy taken by the FED has generated an excess of US currency in the market that has had an impact on prices. From levels close to 1.10 dollars per euro it has reached almost US $ 1.24 earlier this year, currently standing at the US $ 1.19.

The forex market can be analyzed in two ways. Through fundamental analysis (macroeconomics, trade balances, rate differential, fiscal deficit, flows, etc.) or technical analysis (ratios, chartism, real-time metrics).

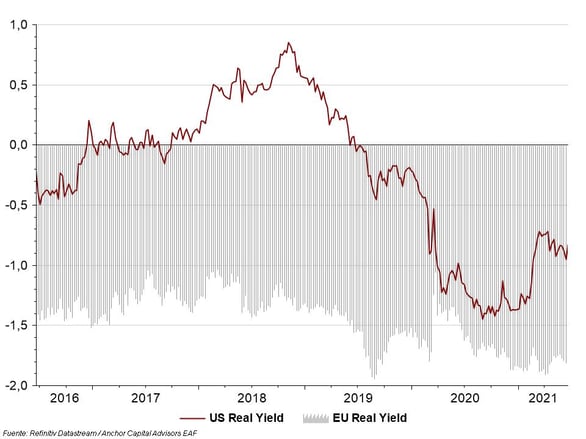

On the side of the first factor, the outlook seems more favorable to the US dollar. Economic growth is projected to be strong for the US due to a more dynamic reactivation - the US will return to pre-pandemic GDP levels before Europe. Added to this, rising interest rates would favor a positive carry for the dollar, in a field where the euro a priori will continue with negative rates for several years. Although the American trade and fiscal deficit are much higher (a source of fragility for the dollar), if we analyze the historical series they have always been, they would not indicate a high interference in the exchange rate.

In the field of technical analysis, the situation does turn favorable to the euro. In recent weeks, the US dollar has appreciated from 0.81 to 0.84, and indicators such as the RSI or the MACD (two momentum indicators) mark an oversold of the euro in the short term. Added to this, the euro seems to have touched support at 1,186 USD / EUR, predicting a rebound in the short term that favors the euro. Added to this, the net long positions in the euro are at their highest since the end of February - indicating a change in trend in favor of the EU currency.

In conclusion, many factors affect the exchange rate, and when it comes to gaining exposure or hedging portfolios, a flexible view is essential. Being favorable to the dollar in the long term is not incompatible with reducing exposure due to potential short-term risks (or vice versa).

-3.jpg)