Biden and his economic plan: a complicated balance?

On March 31, Joe Biden unveiled the long-awaited American Jobs Plan (AJO).

What is the dimension of the plan?

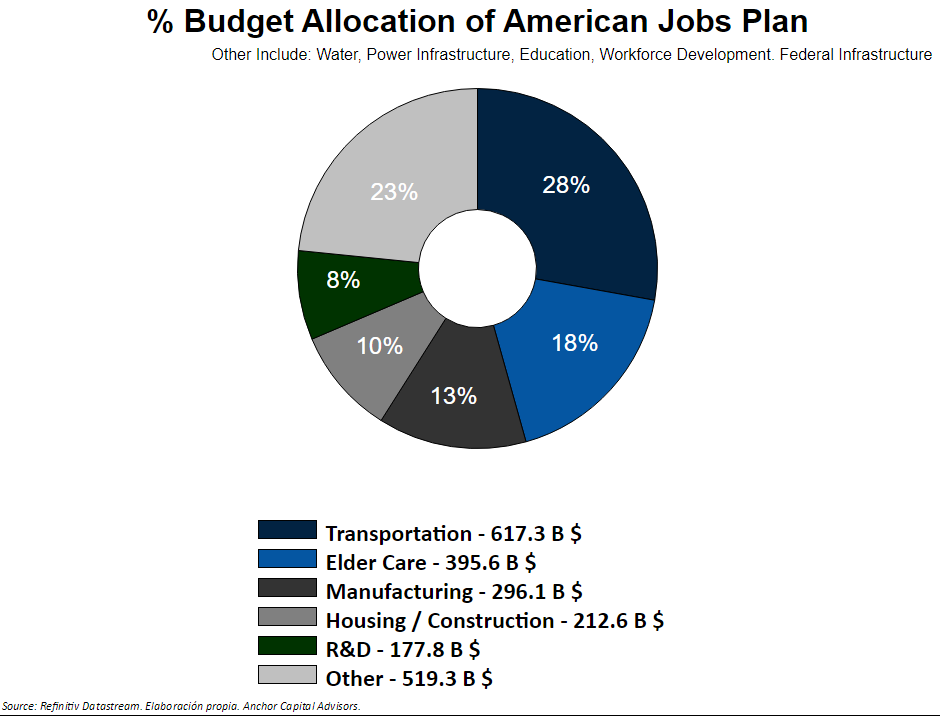

The plan proposes a direct injection of $ 2.3 trillion over ten years. To give us an idea, Biden will inject almost twice the GDP of Spain into the American economy. In other words, a direct injection of approximately 10% of the country's GDP.

In any case, if we look at it year by year, it represents an investment of 1% of GDP per year, which, seen this way, does not seem like such a high figure either.

As popular wisdom says, nothing is free. The possible harmed by the stimulus plan could be the following economic agents:

- All American companies: one of the main sources of financing for the plan will be the foreseeable rise in income tax. Currently, this is at 21%, and it is considering raising it to 28%.

- Non-renewable energy producers: apart from the increase in their tax rate, they will be affected by the increased competitiveness of the renewable sector.

- High-income earners: since taxes will be raised on the sections with the highest income.

Will it improve the economy?

We could say that state intervention in the economy is the main point of conflict between schools of economic thought.

In this case, Keynesian thinking clearly prevails, which advocates state intervention to relaunch the economy through public sector.

Everything seems to indicate that, with this plan on the table, the American economy will draw a more pronounced growth than other economies. To all this, the low interest on the debt will be key to financing the plan, since Biden is taking advantage of this good market moment to finance itself at a lower cost.

Only time will dictate whether the American Jobs Plan serves to help the American economy, but it seems that the markets, for now, are betting on a positive scenario.